The role of cash flow management for small business success

Feb 6, 2022

Published by: Ian Linton

Small businesses face many challenges, with one of the biggest obstacles being cash flow management. Cash flow problems can put a serious bottleneck in your, and many failed small businesses cite cash flow as the most significant detriment they experienced.

What can growing businesses do to ensure they can generate cash, control cash movement and keep growing?

Cash flow management is a huge part of finding success as a business owner. From understanding cash budgeting to ensuring profits stay strong, 42% of small business owners are concerned about their cash flow management.

What exactly is cash flow management, and what can you do to stay in control of your business’s cash at every turn? Today, learn from the top tips that can help you secure small business success.

What is cash flow management?

The first step to improving cash flow is to understand what exactly is meant by cash flow management.

Cash flow is all of the money that is coming into your business, as well as what you are paying out. When you have positive cash flow, you are receiving more money than is going out.

Cash flow management is the daily, weekly or monthly tracking of expenses, payments collected, credits and every other transactional aspect of your business. It allows businesses to see where their money is going, how much money they have on hand and if that balance is correctly managed.

Having good cash flow management is important to ensure that you are able to pay for all commitments as they come up while also knowing when you can focus on growing your business.

Cash flow vs profit

One of the most important distinctions to make is that cash flow is not profit. The two could be equal in specific scenarios, but they are not the same thing. Even if you have high profits, your cash flow could be low, leading to issues in your business.

Financial accounting focuses on tracking net income and profit. Profit takes into account sales that are made even if you haven’t received the money yet, and it doesn’t always account for bills that you have paid, depending on how your finances are recorded. Profit is broad: it looks at the financials of a business over a specific period.

Cash flow, on the other hand, is simply how money moves in your business. Inflow is the money that comes into your accounts, such as the money collected from sales. Outflow is the money that leaves your accounts, such as paying employees or buying raw materials. Cash flow is specific and in the moment: it dynamically records day-to-day business changes.

How cash flow management helps you find success

When small businesses are aware of their cash flow, they can operate more reliably. From forecasting expenses to predicting when you can expand, cash flow helps at many points along the way. Here are some of the primary reasons that you need to take care of your cash flow management.

Build strong relationships

Your investors, customers, suppliers, employees and other business partners are all relying on you being able to continuously do business as usual.

When facing cash flow shortages, many businesses struggle to keep up with demand, pay off incoming shipments or even pay their employees. This negatively affects the relationships that your business relies on. Maintaining adequate cash flow is essential for your small business to thrive.

Identify potential savings

When you’re actively keeping track of your cash flow, it becomes much easier to see where you are spending too much, where there is excess cash sitting and other aspects of your immediate business that are hard to see in profit loss modules.

By managing your cash flow, you can begin to find potential savings and improve business from the very center of things.

Grow your business

Finally, cash flow management keeps you in tune with the exact funds you have available. Making plans to expand your business, add a new supply line or expand your physical presence can be more successful when you know exactly what your cash situation looks like.

Continuous, positive cash flow helps you invest money in the right ways without investing too much. Without properly managing cash flow, however, it can be difficult to make these decisions.

Tips for improving cash flow management

Regardless of your business size or industry, there are a lot of great tips out there for how to improve your cash flow management. These are some of the best ways that you can make your cash collection, management and distribution more efficient than ever before.

1. Make cash flow a priority

If you haven’t yet learned how to track and manage your company’s cash flow, make that a priority starting today. Your business has a significantly better chance of success if you protect your cash flow, but you can’t do that if you don’t pay attention to it.

Start by identifying and finding efficient ways to track the following:

Accounts receivable

Credit term limits for customers

Credit policy terms

Inventory versus sales

Accounts payable

By keeping up with periodic checks of your cash flow, your business will be able to plan around times when covering expenses may become more difficult. Keeping aware of potential problems like this helps you find quick solutions so you can get back to growing your business.

2. Control incoming payments

Customers ordering products from you doesn’t always translate to cash in your accounts in a timely manner. Systemizing your accounts receivable is key to ensure that you’re tracking payments, following up when payments are delayed and keeping your overall cash flow in order.

Do what it takes to ensure that you’re in control of when you’ll be paid, how you’ll be paid and how those payments will be recorded. Feel free to use online payment processing software to control these processes.

Set clear payment terms

Make sure you control the payment terms used with customers. Otherwise, you’re at risk of loose payment terms creating cash flow problems. Make sure that your terms are strict when extending any type of credit to customers. Customers that will help grow your business will be happy to follow the terms.

Automate where possible

Another thing that you can do to help control accounts receivable is to integrate your system with high-quality billing software. Manually sending out invoices can cause a lot of problems and increased overhead costs; investing in automated billing software can reduce those costs.

Automating collections so that your staff can review accounts receivable more easily is also a good idea. This allows your staff to focus on collecting and highlighting potential problem areas.

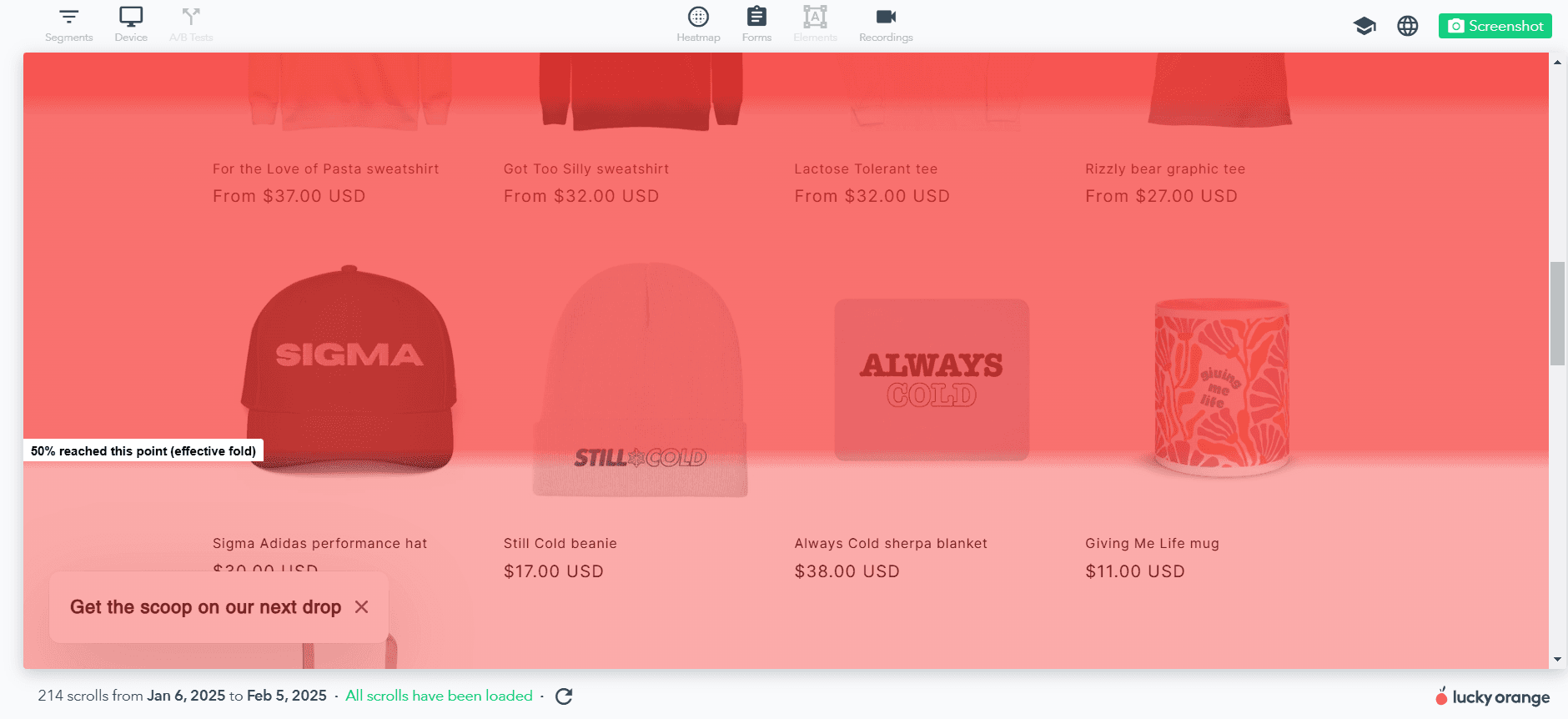

3. Improve conversion rates

Another way to help your cash flow management is to have better cash flow. Cash flow management isn’t just about tracking and automating; it’s also about finding ways to increase your positive flow as much as possible.

One great way to do this is to get more customers and clients. Most businesses lose potential customers as their websites fail to convert, but they don’t always know where to fix this issue. Putting energy and funds into finding the holes where customers are slipping through is a great way to improve conversion rates.

The added information gained from improving conversion rates can also help you to increase revenue from customers in other areas, leading to increased cash flow across the board.

Make time for cash flow

Setting up a great cash flow management system can feel overwhelming and time-consuming. It is definitely a process that takes considerable investment, but the return on that investment is huge. There is nothing that can replace well-managed cash flow. Take time to slow down and prioritize this aspect of your business so that you can keep growing reliably for years to come.